Acquisitions

Value Add

More than $400 million of buying power

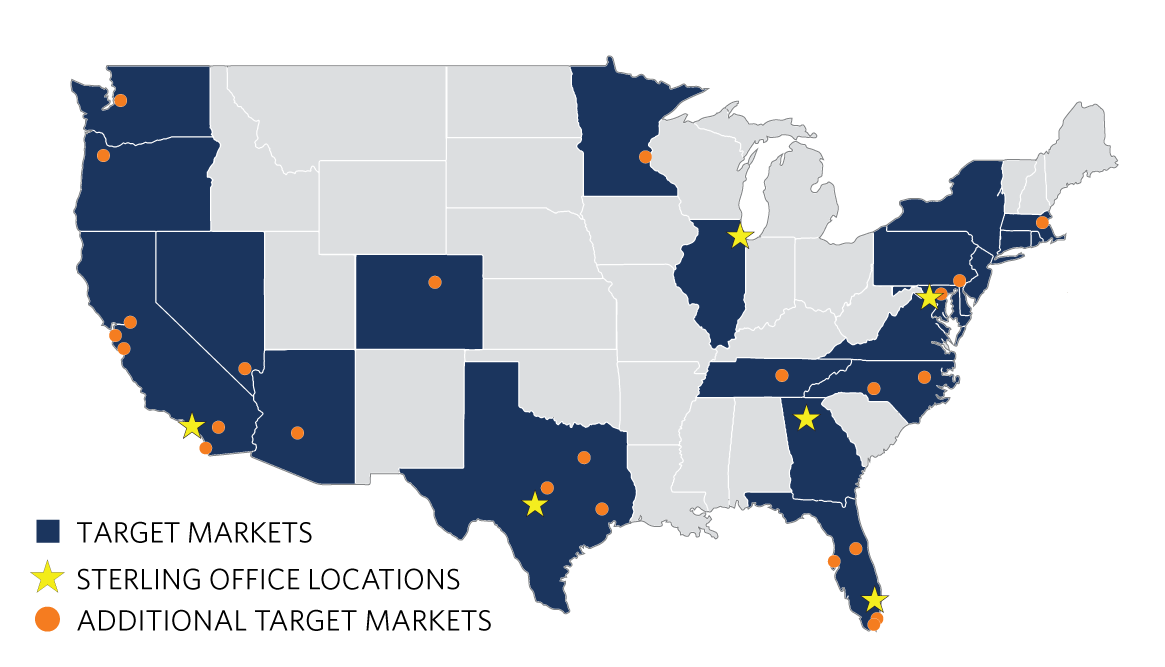

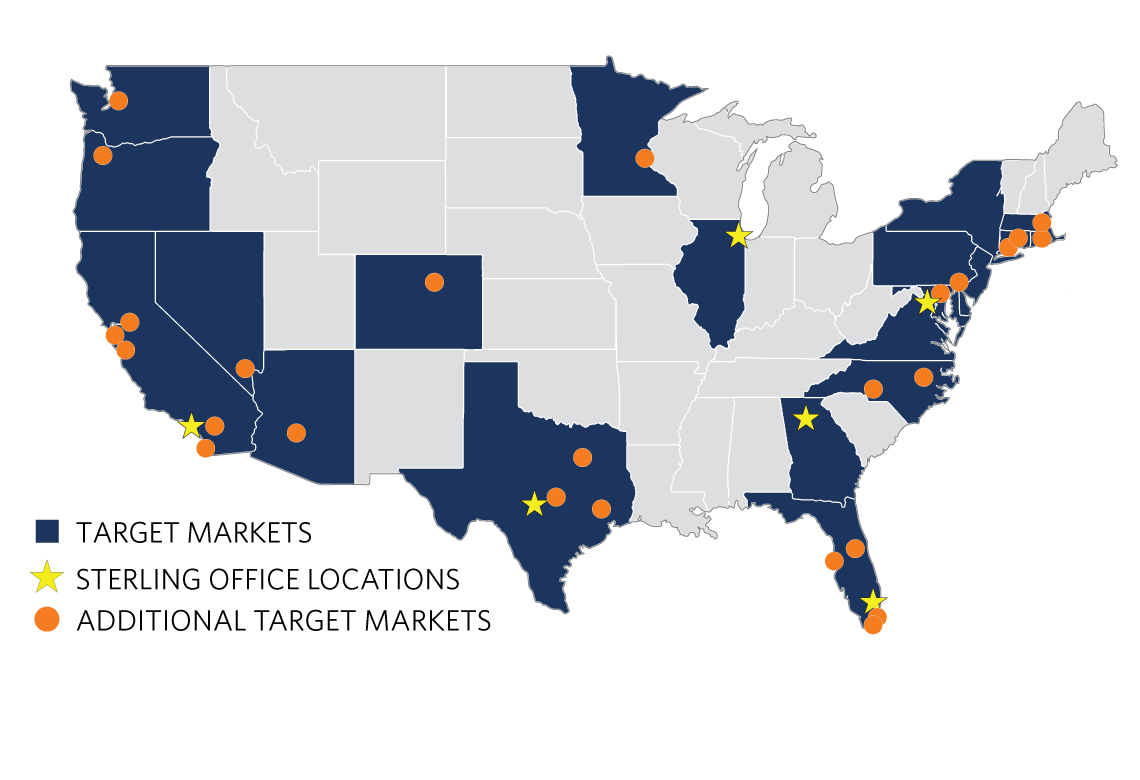

Sterling has more than $400 million of buying power through its current Fund, Sterling Value Add Partners III (“SVAP III”). The characteristics we seek in our targeted Value-Add Retail real estate investments include:

- Major market MSAs

- In-fill locations, 75,000 people in 3-mile radius

- Potential for significant income growth

- Real estate fundamentals more important than credit of tenants

- Below market rents

- Redevelopment opportunities

- Unique opportunities

- Loan originations and/or workouts

- Deal size: $10 million to $1 billion

- Individual deals and/or portfolios

Core/Stabilized

More than $400 million of buying power

Sterling has more than $400 million of buying power through its current Fund, Sterling United Properties II (“SUP II”). The characteristics we seek in our targeted stabilized grocery-anchored real estate investments include:

- Core/stabilized grocery-anchored shopping centers

- In select major MSAs where grocer is No. 1 or No. 2 of pure grocers from a market share perspective

- Primary MSAs (Top 50)

- Stable, predictable cash flow/anchors have solid sales with reasonable health ratios

- 90%+- occupancy

- Deal size: $10 million to $250 million

- Individual deals and/or portfolios

Logsitics

More than $250 million of buying power

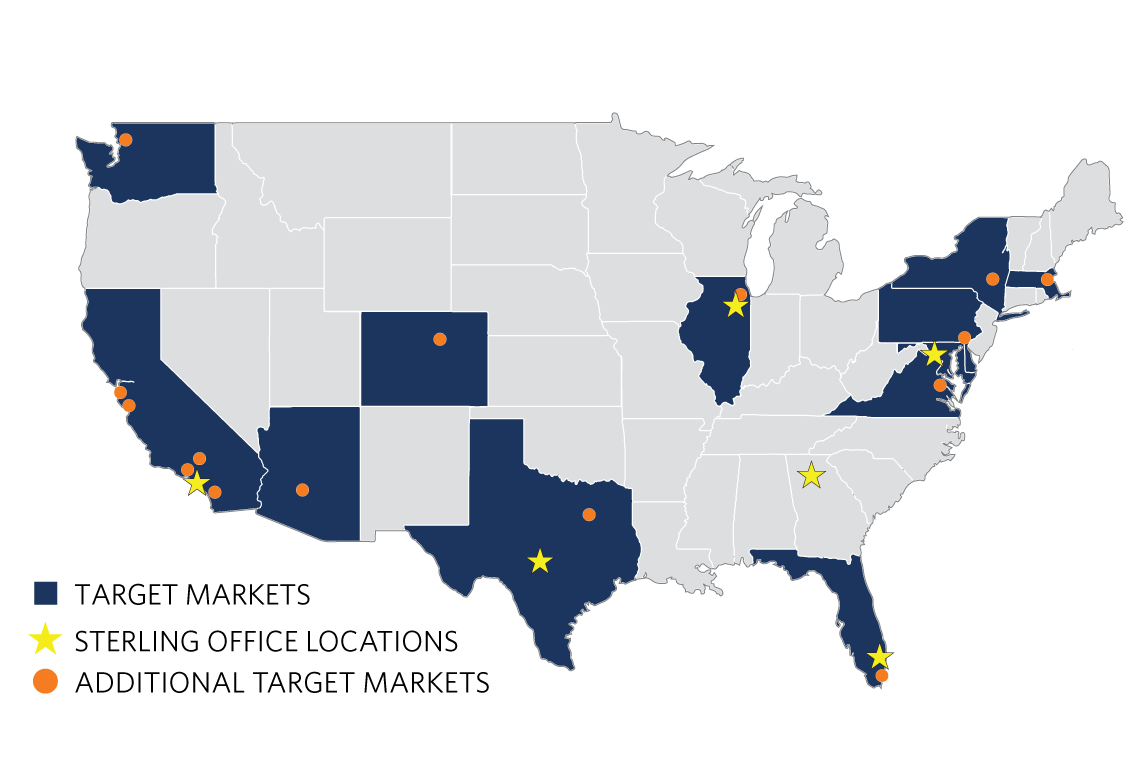

Sterling has more than $250 million of buying power through its current Fund, Sterling Consumer Logistic Properties I (“SCLP I”). The characteristics we seek in our targeted LAST HOUR® Logistics real estate investments include:

- Primarily Major Coastal MSAs

- Vacant retail buildings not less than 50K square feet

- Deal size: $5 million to $100 million

- Individual deals and/or portfolios